Sherry Young Stands Out Among NH Attorneys

Co-Founder of Rath, Young and Pignatelli Receives BIA’s Lifetime Achievement Award. https://members.biaofnh.com/news-releases/Details/sherry-young-stands-out-among-nh-attorneys-183381

Rath, Young and Pignatelli, P.C. is pleased to announce the new additions to our Shareholder team

Superior Court Recognizes Breach of Fiduciary Duty Against State and Contractors in Cases Involving Failure to Protect Children

Senior litigation shareholder Mike Lewis published the following piece in the NH Bar News on developing trends in the area of state civil rights practice, focusing on two major decisions issued by the NH Superior Court in the past year. Attorney Lewis describes and examines how these decisions apply the doctrine of fiduciary duty. He […]

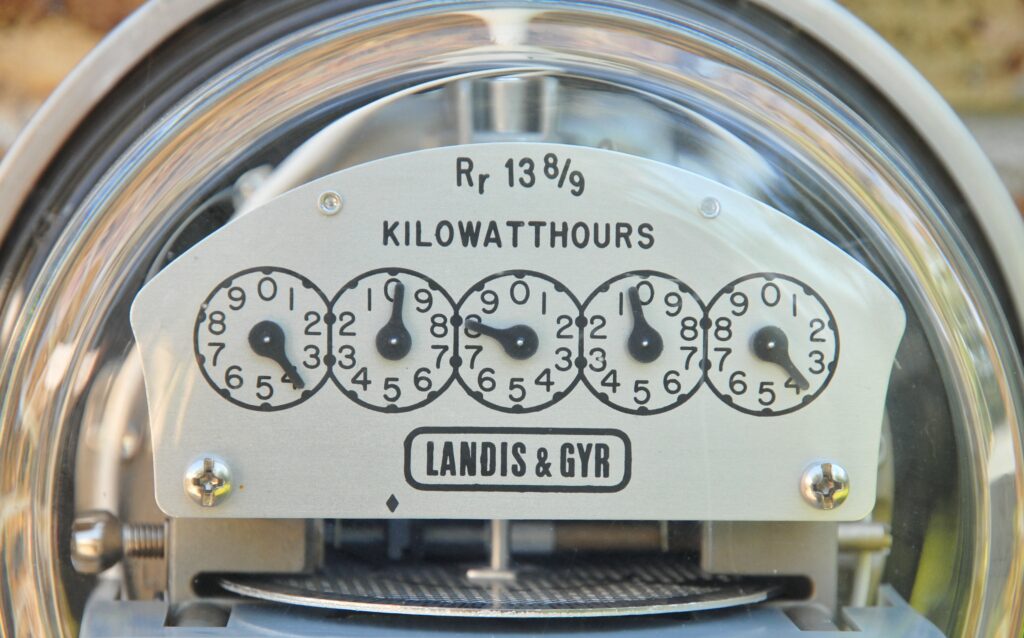

Maine Modifies Net Energy Billing Programs

Eric Asquith and Chuck Willing discuss a change in law affecting eligibility of renewable energy projects over 1 megawatt for Maine’s net energy billing programs.

READ FULL STORY

NH Supreme Court Extends Equal Protection to Children in Litigation Against DCYF

Michael S. Lewis publishes a piece in the NH Bar News on a recent decision conferring constitutional rights on the victims of child abuse and neglect in New Hampshire.

RYP’s Mike Lewis and Cassy Moran’s Victory for Free Speech

In an opinion released April 17, 2023, the Rockingham County Superior dismissed a 396-page defamation lawsuit against an RYP client who reported sexual assault allegations to a local media organization. The motion to dismiss filed on behalf of our client argued that the statements she made to the media were protected by the state and […]

Ruling raises the question: What isn’t an enforceable web-based contract?

Senior litigator Michael S. Lewis, also an adjunct contracts law professor who has published scholarship in the subject area, analyzes a recent federal court decision considering the enforceability of the terms and conditions of a web-based consumer-facing platform. Lewis notes the need for attorneys and web designers to be on the same page with regard […]

FTC Takes Aim at Non-Compete Clauses

On January 5, 2023, the Federal Trade Commission published a proposed rule that would ban (and importantly, nullify existing) non-compete agreements with limited exceptions. The rule would go into effect 60-days after it becomes final. Employers would have 180-days after publication of the final rule to comply. Under the proposed rule, a “non-compete clause” includes […]

Michael Lewis and Cassandra Moran Address the Severe Shortage of Attorneys for Criminal Defendants Across the State

New Hampshire Public Radio and New Hampshire Union Leader reported on a New Hampshire Supreme Court case involving a criminal defendant who was receiving inadequate medical care at the Hillsborough County House of Corrections. RYP’s team included Michael Lewis and Cassandra Moran, who were appointed to represent the defendant at the request of the judiciary to address the severe shortage of attorneys for indigent criminal defendants across the state.

RYP’s Kathryn Michaelis Speaks at New England State and Local Tax Forum

On November 16, 2022, the New England State and Local Tax Forum held its 11th annual conference in Newton, Massachusetts. RYP’s Kathryn Michaelis presented an update on New Hampshire and Vermont state tax developments. Michaelis is the Vice President of the Forum, which is a non-profit organization dedicated to state tax education in New England […]